La création d'un studio photo requiert une approche méthodique dans le choix du matériel. Un équipement bien sélectionné permet d'obtenir des résultats professionnels, que ce soit pour la photographie de portrait ou d'objets. L'investissement initial mérite une réflexion approfondie pour optimiser son budget. Les bases d'un éclairage studio performant L'éclairage constitue la pierre angulaire d'un …

Quel avenir pour la photographie à l’ère d’Instagram : la révolution démocratique qui bouleverse les codes

La photographie connaît une transformation sans précédent avec l'arrivée des réseaux sociaux, notamment Instagram. Cette plateforme a redéfini la manière dont nous créons, partageons et consommons les images, modifiant profondément le paysage photographique traditionnel. L'évolution des pratiques photographiques avec Instagram La plateforme Instagram a initié une révolution dans l'univers de la photographie, bouleversant les codes …

Maitrisez l’art de photographier le ciel etoile avec la regle des 500

La photographie du ciel étoilé représente une discipline fascinante qui allie technique et créativité. La règle des 500 constitue un guide essentiel pour capturer la magie des astres sans flou ni traînées lumineuses. La règle des 500 en astrophotographie expliquée L'astrophotographie requiert une approche méthodique pour obtenir des images nettes du ciel nocturne. Cette règle …

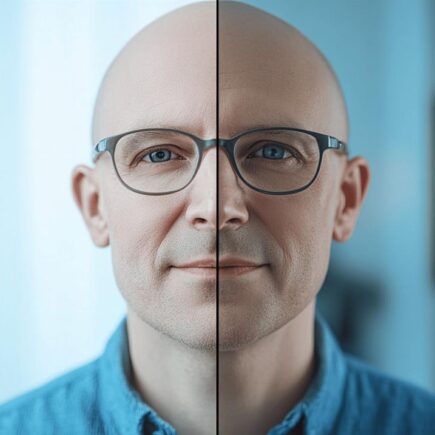

Le filtre chauve sur photo révolutionne la projection capillaire sur 1001photographes.com

Les innovations en matière de retouche photo atteignent des sommets avec l'arrivée du filtre chauve, une technologie qui transforme l'expérience utilisateur sur 1001photographes.com. Cette avancée technologique permet aux utilisateurs d'explorer une nouvelle dimension dans la manipulation d'images. La technologie derrière le filtre chauve L'intelligence artificielle révolutionne la retouche photographique grâce à des algorithmes sophistiqués. Les …

Paysage rural, plaines et villages style Klimt : Comment capturer l’ame doree des champs

La rencontre entre la photographie rurale et l'esthétique de Gustav Klimt ouvre une dimension artistique unique, où les paysages champêtres se parent d'une aura mystique. L'art du maître autrichien transforme les scènes rurales en tableaux somptueux, mêlant nature et symbolisme. L'inspiration artistique de Gustav Klimt dans la photographie rurale La vision artistique de Gustav Klimt, …

Top 10 des smartphones photo qui revolutionnent la photographie mobile en 2025

La photographie mobile connaît une révolution majeure en 2025, avec des smartphones aux capacités photographiques remarquables. Les fabricants repoussent les limites technologiques, proposant des appareils dotés de capteurs haute résolution et de fonctionnalités avancées qui transforment l'expérience photographique. Les innovations technologiques des capteurs photo en 2025 Les capteurs photo des smartphones modernes atteignent des performances …

Relooking – Le magazine mode et photographie en vogue : 10 poses essentielles pour un shooting reussi

Le monde de la photographie mode associe talent artistique et maîtrise technique pour créer des images saisissantes. Les poses représentent un élément fondamental dans la réussite d'un shooting photo. Découvrez les secrets des photographes professionnels pour sublimer vos modèles. Les fondamentaux de la pose naturelle La photographie de mode nécessite une compréhension approfondie du langage …

Comment créer un album photo sur ordinateur en 5 étapes simples et rapides

La création d'un album photo sur ordinateur constitue une belle façon de donner vie à vos souvenirs. Cette méthode simple demande une organisation méthodique et quelques étapes fondamentales pour obtenir un résultat satisfaisant. Préparation et sélection des photos La réussite d'un album photo numérique commence par une étape fondamentale : la préparation. Cette phase initiale …